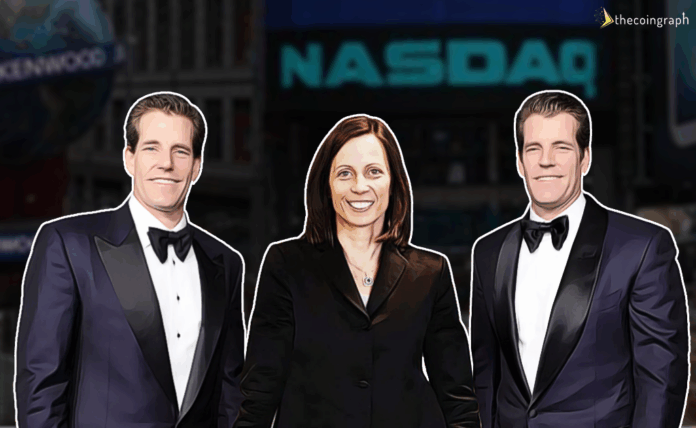

On Wednesday, April 25, one of the biggest cryptocurrency exchanges ‘Gemini’ headed by the Winklevoss twins announced its partnership with Nasdaq in order to prevent its users from being victims of market manipulation.

This is the first-of-its-kind deal in the crypto space where Gemini will be using Nasdaq’s SMARTS Market surveillance technology that will help to alleviate any sort of market manipulations while at the same time will report about any unusual trading behaviours. This system will allow Gemini to monitor activity all its trading pairs like ETH/USD, BTC/USD and BTC/ETH.

In its official blog post, Gemini says

“Building a rules-based marketplace is critical to our mission to build the future of money — individuals and institutions need to feel safe and secure when trading. To that end, we are excited to announce that over the coming months we will be implementing Nasdaq’s SMARTS Market Surveillance technology to monitor our marketplace.”

While commenting on this partnership, Tyler Winklevoss said:

“Our deployment of Nasdaq’s SMARTS Market Surveillance will help ensure that Gemini is a rules-based marketplace for all market participants.”

Nasdaq describes its SMART Surveillance Technology as the one which “automates the detection, investigation and analysis of potentially abusive or disorderly trading.”Currently, this technology is being used by several regulators, marketplaces and market participants.

Valerie Bannert-Thurner, Senior Vice President and Head of Risk & Surveillance Solutions, Nasdaqsaid: “Gemini has been a leading voice in advocating for stronger transparency and thoughtful regulation of the cryptocurrency markets – views we deeply share and have put into practice as a market operator and technology partner.”

Valerie further added that the New York State Department of Financial Services (NYSDFS) regulates Gemini, holding it to the utmost standards in terms of capital reserve requirements.

This is a major milestone in the application of SMARTS- and an important indicator of our commitment to expand the use of our market technology into non-traditional marketplaces, as well as new frontiers beyond the capital markets.“